Asset Manager Profile

In the last 3 years, Beach Point Capital Management has acquired 1 company. It has also invested in 1 other.

Beach Point Capital Management’s most common sectors for investment arebusiness services (50%) and food (50%) . The Firm’s most common investment types include secondary buyout (50%) and stake purchase (50%). In total, Beach Point Capital Management has invested in 1 US state.

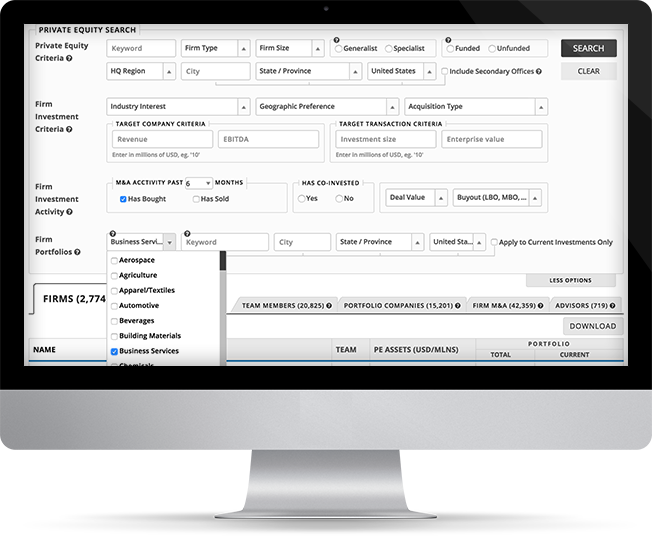

Join Mergr to view Beach Point Capital Management’s full profile and discover more small asset manager investors just like it.

M&A Summary

-

M&A Total Activity2

- M&A Buy Activity2

- Total Sectors Invested 2

- Total Countries Invested 1